Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

Author: Thomas Riemer

Best MoeTube Alternatives: This article is about MoeTube Alternatives to watch free anime online. The Internet has been a big reason for the past few years. Movies and TV shows can be sent to websites like AnimeDao, YouTube, GoGoAnime, and AnimeFreak, among others. As a result, many people watch Japanese anime no matter the time period. MoeTube is similar to YouTube but for anime. What is MoeTube? MoeTube is a free website that only has anime movies and shows. The same people who made YouTube are in charge of this plan. The MoeTube project is now in beta. MoeTube site has…

Best PSP Emulators for Mac: We all desire to go back in time, especially to the days when we would spend hours at home playing PSP games. Isn’t it fun to go back in time? The PSP featured some of the best games, which still thrill us. This Sony handheld device was rather popular back then because of its portability and, as previously noted, the multitude of mind-blowing games it could play. Popular games include GTA, Tekken 6, God of War, Naruto, etc. Although you can still buy a PSP, adding more devices to the pile of devices we currently own…

Streamonsport Alternatives To Watch Sports For Free: Streamonsport is the best live streaming site that allows you to watch football matches and other sports and sporting channels in live streaming for free and without registering. Football is no longer a secret; Streamonsport is the most popular sport. As a result, the sport has become the subject of numerous offline and online demands. And, for the past several years, TV has not been the only option to watch your favorite football events. Several venues, such as TV, allow you to attend the most important meetings. As a result, the issue of…

What can you do to find out if your loved one is safe? You may be concerned if your lover is going on a solo vacation. Is your adolescent daughter or son acting strangely? It’s possible that they’re being bullied. If you’re wondering Track a cell phone location for free without their knowing, this is the guide for you. The desire to track a cell phone location for free someone’s position isn’t just for spying. You may have legitimate reasons, such as wanting to know where your children or elderly parents are. As a result, many are looking for a…

Best 1Movies Alternatives To Watch Movies Free Online: The internet has become an important component of people’s daily lives. With the click of a mouse, anyone may watch any movie, whenever and however they choose. However, that is not conceivable when viewing television shows that people are slowly moving. With that in mind, 1Movies is a website that will surely meet all of your streaming needs. 1Movies is a website that provides free online streaming of movies and TV shows. 1Movies offers numerous features that define it from its competitors. The beautiful and user-friendly UI, on the other hand, is…

Are you concerned that your processor or graphics card is overheating? In this brief guide, you’ll learn about the ideal CPU and GPU temperatures! A gaming PC must be serviced on a regular basis. This is a hard truth that many people discover the hard way. Why? As a result of overheating! Once you’ve got your brand-new gaming setup in place and started using it then you will check good CPU and GPU temps for gaming, time can fly by, and it’s easy to forget that the PC requires regular maintenance. And if you do forget, it will remind you…

WcoStream helps make it easy for anybody that wants to watch Japanese animations to stream content online. Wco Stream provides people access to a range of multiple services that let them access media without any restrictions and without paying a single penny. Anyone who wants complete access to this WcoStream site must have signed up by giving a valid email address that can be checked by clicking the activation link sent to that email. WcoStream also comes with a legal domain, so users don’t have to worry about any illegal restrictions and can stream as many episodes as they want.…

Best AZMovies Alternatives To Watch Movies Free Online: AZMovies is an online entertainment platform where you can watch all of the world’s greatest movies online. The main page of the AZMovies website includes a list of the top ten movies, forthcoming movies, and movies added lately, which can be useful in keeping movie buffs up to date on recent developments in the film industry. AZMovies also has a separate library of movie stars where you can see their professional background and filmography, which might be useful if you don’t know the name of the movie you’re looking for. A user…

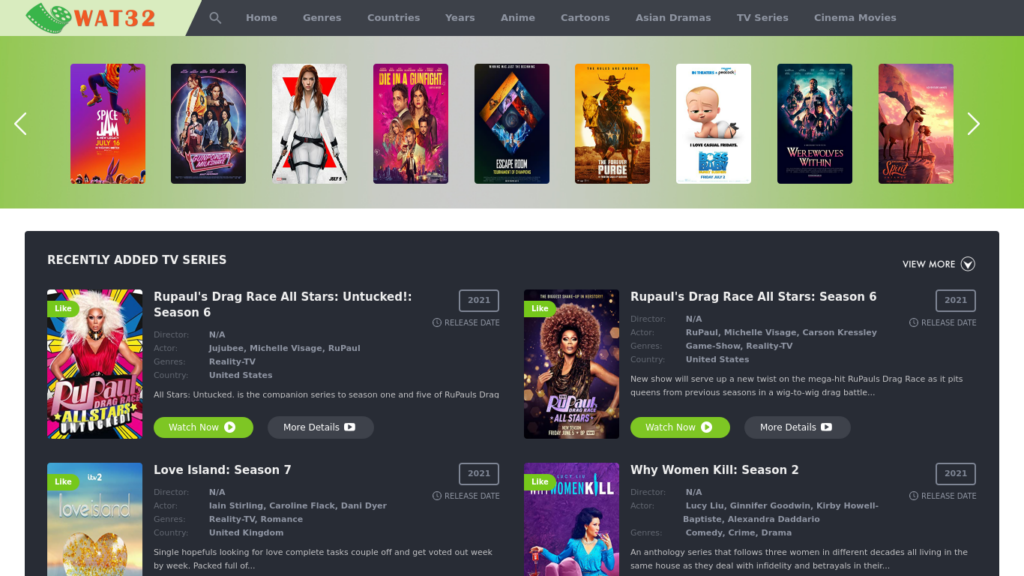

Best Wat32 Alternatives To Watch Movies Free Online: Wat32 is a popular website where you can watch free HD movies and TV shows. Wat32 is a gateway to the Internet’s largest movies library. There are movies of many types and genres available, including romance, thriller, comedy, drama, mystery, action, fiction, etc. Wat32 has a fantastic, simple, and user-friendly interface to avoid complexities. You may also watch classic and non-classical movies with the most recent movies. This Wat32 platform’s vast database contains movies from every country. This website also has a variety of video players. It is completely free to download…

AnimeTake is well-known for providing the best English subbed and dubbed anime in HD. In addition, users may watch anime for free on the website, which is an anime video-sharing platform. AnimeTake is widely regarded as the website where most anime fans spend their time. The AnimeTake website has a large collection of anime movies and shows. In addition, there are several anime genres to pick from, including Horror, Comedy, Romance, Fighting, Adventure, and many more. Aside from watching these movies and shows for free, AnimeTake offers the most fantastic collection of uploads, most of which are reasonable quality. By…